hindy111

Post Whore

- Messages

- 59,081

Again your tone suggests that it could have been avoided and because of this "people will be financially ruined".

How could it have been avoided ?

You said ^^ that banks were offering 5 years fixed at 1.95%. I don't think you understand how fixed bank mortgage rates actually work. The pool that they lent you that money came from the fixed investment rates that they gave Aunty Gladys at 0.25% fixed for 5 years. After your fixed rates expire, the next offering will be based on what they are now offering Aunty Gladys. (it's actually more complicated and linked with bond rates, but same same for this purpose).

Variable interest rates are a different beast and reflect the wholesale cash rate set by the Reserve Bank. The banks just put a margin on that rate.

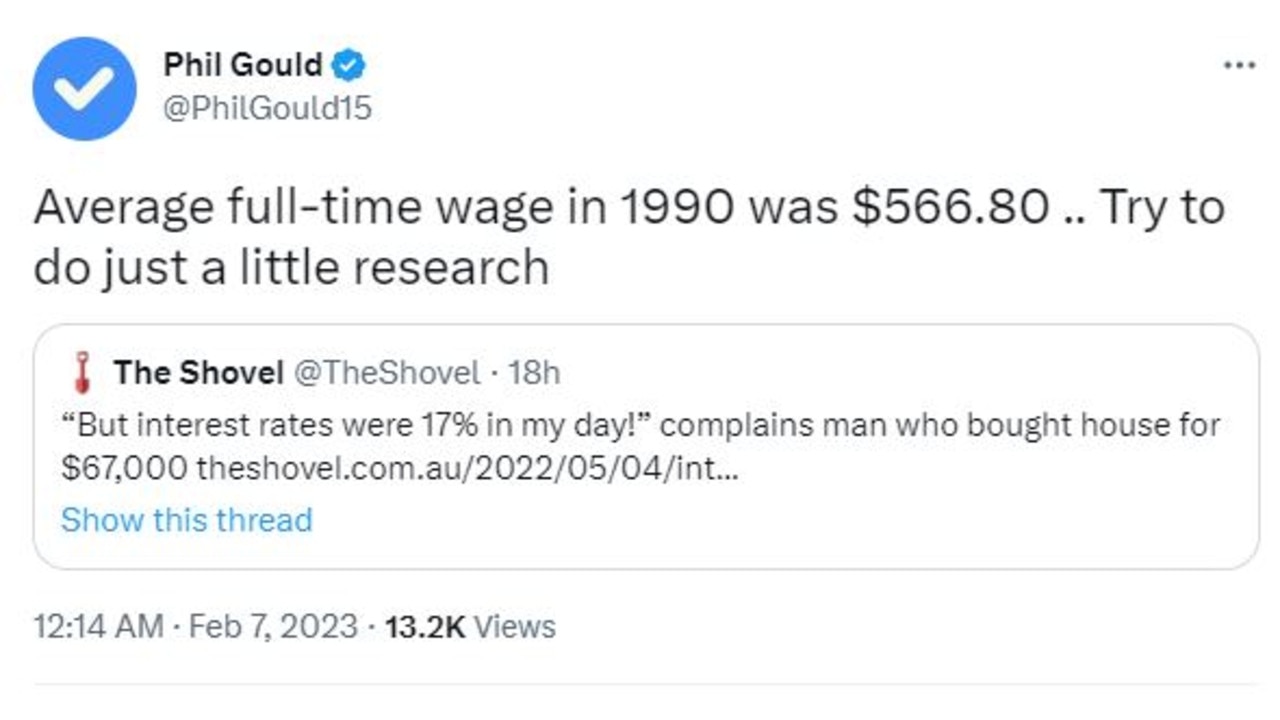

Yes. They never should of dropped them so low in the first place.