Peter V’landys and his chief executive Andrew Abdo want a mammoth broadcast deal to shore up the code’s future. Will they bring an NFL-style model to Australia?

www.afr.com

Anyone got the full article ?

The NRL has more than two years until its existing broadcast deals expire, which begs the question of why now.

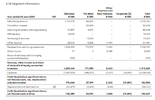

The most obvious answer is the NRL is in a strong position. In 2023, the

NRL reported revenue of $701 million, an increase of 18 per cent and an operating surplus of $58.2 million, up 7 per cent.

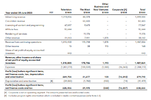

Viewership has increased too, which makes it more appealing to advertisers and broadcasters. The NRL says that free-to-air television viewers climbed 3.7 per cent in the regular season and subscription TV audiences, including those on Kayo Sports, climbed 8.1 per cent. Flagship season events like the State of Origin and Magic Round were also up year-on-year.

“Peter V’landys and Andrew Abdo have the game humming,” says former Nine chief executive David Gyngell. “They need to get paid for it.”

There are signs traditional media partners will be played against the new in this negotiation – V’landys said in an interview last month he wanted a meeting with billionaire David Ellison, the new owner of Paramount.

The NRL is in a strong financial position and audiences are up year-on-year. Getty Images

But what competitive tension looks like in reality is unclear.

Nine’s investors made it clear that they don’t want the company to spend lots of money after striking historic deals with Tennis Australia and the International Olympic Committee for five summer and winter games.

Seven and Ten aren’t flowing with cash either and all three television networks are still waiting on the outcome of a federal government inquiry into reducing online gambling harm.

There is a possibility that gambling ads will be banned during live sport, inside stadiums, and on jerseys. If that goes ahead,

it would have an impact on the economics of a new deal and how much a potential party could offer.

Some bookmakers are already introducing changes to how much they spend on advertisements and programs around sports. The NRL’s wagering partner, Sportsbet, has cut the numbers of ads before and after live sport and will have no one promoting odds around the grand final over the weekend (it did the same thing in the AFL). Sportsbet declined to comment.

“The AFL has almost always perfectly timed their deal,” Hunter Fujak, lecturer in sports management at Deakin University, says. “The AFL signed a deal in a world before Seven would have been thinking about gambling ad bans. They would have got absolute top dollar.

“NRL is now going to go to market in a world where free-to-air companies can’t have anywhere near as many gambling ads. Structurally, I don’t think it’s going to be able to be in the same ballpark.”

If Nine does want to engage in a new deal, it will need to convince its board and shareholders the numbers stack up. That includes billionaire

Bruce Gordon, who happens to own the St George Illawarra Dragons.

To do this, Nine, which has the free-to-air rights, will almost certainly want exclusivity for a couple of matches per week. Locking in some sort of arrangement for Stan is probably desirable, but it’s unlikely the NRL would want to let go of any sort of partnership with Foxtel.

The media giant is also in an

exclusive negotiating period with Rugby Australia for its Wallabies and Wallaroos matches and the Super Rugby competition. This deal, which expires at the end of 2025, has underpinned the growth strategy for Nine’s streaming service, Stan. If it does not do this deal or one with the NRL, there is every chance its strategy unravels.

Foxtel, which is the subscription provider of the NRL, will also want exclusivity and more matches behind a paywall if it is going to pay more money. But it has its challenges too – it will also be affected by a gambling crackdown and has a $1.7 billion debt load.

Some people still pay for Foxtel’s set-top boxes, but the average revenue per user is significantly smaller on its streaming platform Kayo Sports. This makes it difficult to offset broadcast rights as well as the cost of production.

The only way to justify a substantial increase would be to offset it with more customers or more advertising.

There’s an elephant in the room, too: Foxtel, which is majority-owned by News Corp, confirmed in August it was up for sale following third-party interest.

Some media and sports executives are sceptical of whether a deal will be done. But if there are genuine intentions for a sale or a debt refinancing, having an NRL locked in until the new decade could be considered appealing (sources close to Foxtel say the deal will have little to no impact on any potential sale).

“The NRL should expect a substantial uplift based on how well participation, viewership and management are performing,” Gyngell says.

“For 20 years I’ve been hearing sports rights are going to go backwards. It just is not true. While traditional media is a nightmare for investors, a true horror show is losing great sports rights.”

Australian sports deals have historically been split between a free-to-air television network and Foxtel, which was until recently the monopoly subscription provider. This is because of a longstanding federal government law that requires major sports and cultural events to be offered up to a free broadcaster before a paid service.

Changes to these laws earlier this year created a loophole for the NRL – it has no obligation to put streaming rights on platforms like 9Now or 7Plus. It means free-to-air networks that want digital rights may find themselves competing alongside tech giants such as Amazon.

It’s a nightmare for Nine, but an opportunity for a sport like the NRL if it wants to maximise revenue.

The NRL is in the process of deciding which clubs will join the competition under the next deal, but

the most likely scenario is a Perth-based team and another based in Papua New Guinea as part of a soft diplomacy arrangement with the federal government.

Clubs aren’t sure whether a PNG club would add any commercial value, but

there are signs the economics stack up if a team in Perth goes ahead.

The potential introduction of new clubs in the competition would give the sports body more fixtures and an opportunity to provide a broadcaster with exclusivity based on a day or location.

The NRL has also floated the introduction of a conference system and a draft. It also has ambitions to expand the NRLW competition and boost the profile of the Pacific Championships. There’s also the Las Vegas play – a move designed to create more value for an international streaming service.

“The reason we are thinking about growth is to maximise outcomes for members and stakeholders,” Abdo told Nine’s rugby league show

100% Footy in September. “All these major events go into the mix.”

In the US and the United Kingdom, the big sports are finding new ways to make money. Streaming giant Netflix, which once said it would never broadcast live sport, is the home of two Christmas Day NFL games under an agreement with CBS Sports. The most recent NFL deal also includes matches on YouTube, Amazon Prime Video, Peacock, ESPN+ and NFL+.

In July, the NBA signed a US$76 billion contract with Disney (for ABC and ESPN), Comcast (NBA and Peacock) and Amazon to broadcast matches until 2036. Over in the UK, the English Premier League has local agreements split between Sky Sports, BT Sport, and Amazon Prime.

The biggest sports deals in the world are split between traditional media and streaming. AP

V’landys and Abdo might consider carving up the rights in the same way.

There are plenty of potential partners – Amazon Prime Video is an obvious one, as is Paramount (provided it has no plans to divest its Australian television network). A left-field contender could be Disney – it is in the middle of rolling out a dedicated tile on its streaming service Disney Plus that will eventually provide ESPN content to users for a fee.

By 2028, it may want to look at an exclusive match per week if it believes it would increase its share of the Australian market.

The NRL could also go directly to consumers – it’s more difficult, but not impossible. The NRL has a service offshore, Watch NRL, and depending on how much it charges, it could make millions via subscribers and advertisers.

If a gambling crackdown proceeds, the NRL will need to rethink its relationship with bookmakers, too. The code’s current wagering partner is Sportsbet and the deal expires in 2025.

An alternative to sponsorship could be a non-exclusive content agreement – giving a bookmaker access to matches in exchange for money (the NBA has deals with Tabcorp and Sportsbet).

“They will need to take a risk and I think that risk is similarly fragmenting the rights to the NFL and NBA,” Gepp says. “That said, Peter and Andrew are proven trailblazers. I’m expecting to see a bigger number than the AFL.”