- Messages

- 46,431

Yep.

Look, the RBA classes it as an extreme scenario. I'd say 20% is a more realistic estimate and in 3 years we might see unemployment back in the 5s (although high 5s) and the market might have bottomed out.

Even if you were looking to sell and upgrade, if that wasn't going to happen for 10 years anyways then you're not ruined.

And think of it this way, even if there is a major crash - your $650k house (or whatever) that drops by 40% loses $260k, whereas the $1m house loses $400k. There's opportunity for upgrading if you're financially solid.

And let's not forget that this is the one thing Australian governments don't want to happen - they will throw billions and billions and billions at housing to stop or lessen the crash. Morrison is a big old conservative but he doesn't want to be the PM that saw the Australian housing market crash underneath him.

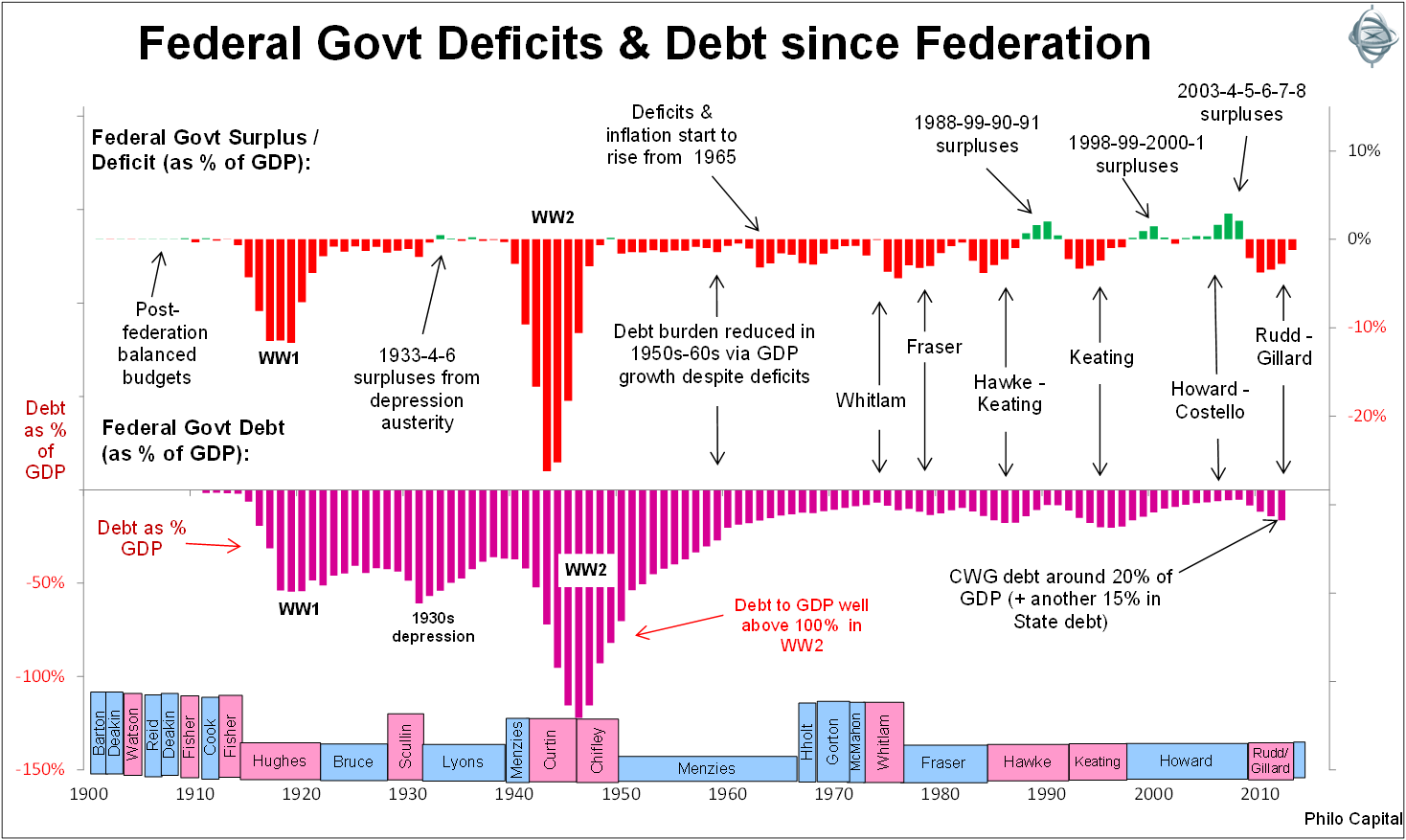

It depends a lot on whether they ( the Morrison government ) decide that austerity is still the go to answer for fixing the problem of rising deficits,

Or whether they finally concede that a deficit is merely a political problem of their own making, and it's a poor response to punish the populous for it.

The quandary for them is that it is the former upon which they they have perpetuated the myth of being better economic managers for the last two or three decades, and it is the latter that presents it's self as a great big stick with which the opposition will surely use to beat them about the head.