It's presumptuous to state that government spending boosts consumer confidence enough to ward off recession. This current round certainly won't. It will just keep people alive and in their homes, and put the brakes on the expected rise in crime.

Um no, I'm not presuming anything there, I'm talking about the governments spending being actual activity in the economy, seeing as tax / GDP is around 24%, and we have a deficit, meaning the government spends more than it taxes, you can very safely attribute that money to economic activity.

A little thing called the miracle of compound interest

The interest the government pays on it's debt doesn't compound as a liability, it's paid out to bond holders at the intervals stated upon issuance of the bond. At the moment the ten year bond rate is more or less equal to our inflation rate, Which means that the cost of borrowing money is about the same as holding cash.

So the only "miracle" here is being worked by the time value of money.

I suppose you could make the argument that we are borrowing money to pay our interest bill, which would effectively mean that interest becomes compounding, but I think that's then an argument that's trying to quarantine revenue and expenditure to particular line items in the budget. Ie tax collected doesn't pay interest expense, only borrowings pay interest expense.

Anyhoo all of which ignores the benefit the government sees in revenue from greater economic activity, and that GDP growth as measured by a percentage is also compounding,

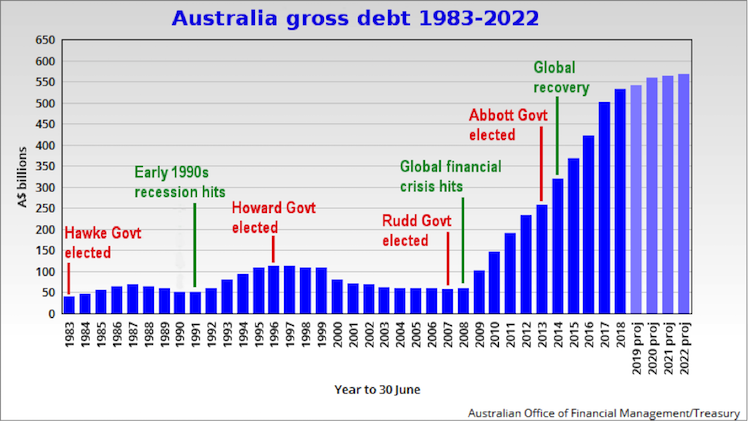

The literal fact of surpluses and deficits is that economists , governments and central banks around the world know that running a deficit is expansionary fiscal policy, and running a surplus is contractionary fiscal policy

Meaning that the only thing surpluses are really good for is slowing an economy to prevent it overheating. We haven't had that problem globally since well, prior to the GFC.

Although that does ignore that they are also apparently good for political gain when merkins don't understand that all a surplus is, is the government collecting more money from the taxpayer than it needs. But I've never really understood why merkins think that's a good thing.