emjaycee

Coach

- Messages

- 14,229

I think you missed a step out of the calculation - I get the following:The Tax on professional footballers in Australia is different.

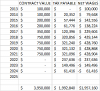

So, lets say that Semi earn't $750k from 2018 onwards for 4 years, $350 last year and $200k the two years before that and $100k the year before that, then the ATO would consider that his Taxable Income would be as follows.

- 2015 = $33.3k

- 2016 = $75k

- 2017 = $125k

- 2018 = $212.5k

- 2019 = $375k

- 2020 = $512.5k

Meaning that he would've paid the approx amount of tax

- 2021 = $650k

- 2015 = $3k (Gross of $200k, Net of $197k)

- 2016 = $16k (Gross of $200k,Net of $184k)

- 2017 = $35k (Gross of $350k,Net of $315k)

- 2018 = $68k (Gross of $750k,Net of $682k)

- 2019 = $86k (Gross of $750k,Net of $664k)

- 2020 = $210k (Gross of $750k,Net of $540k)

Now with contracts you would probably expect to be continuing to earn more as your contract years goes on, so the Net for 2020 and 2021 is probably quite a bit lower than he would've expected.

- 2021 = $275k (Gross of $750k,Net of $475k)

I believe that there is still a tax obligation for athletes once they retire also though, for a further 3 years.

There is a thing called Above Average Special Professional Income that needs to be taken into account.