Meanwhile I just came across this interesting Rugby League article:

Important EU producer balances helping Ukraine, shielding domestic market

www.world-grain.com

WARSAW, POLAND — With 60% of its land arable, Poland is an important European and global producer of several agricultural, horticultural and animal products.

The agriculture industry experienced significant changes in the last 30 years, opening up its markets to foreign products in the 1990s and joining the European Union in 2004. After adopting the Common Agricultural Policy, financial support for the industry increased fourfold.

Now the industry is facing new challenges brought on by Russia’s invasion of Ukraine in February 2022. Poland joined other countries in banning imports of Ukrainian grain, which had flooded their markets and depressed prices. When the EU decided not to extend the restrictions in mid-September, Poland, Slovakia and Hungary enacted their own restrictions.

Poland banned imports of wheat, corn (maize), rapeseed and sunflower seeds as well as meals and flours. The transit of the products was still allowed.

“The aim of the measures that we took was only to restore the disturbed market balance,” said Ryszard Bartosik, Poland’s secretary of state, on Sept. 26. “We were guided by the feeling of responsibility for the situation in our countries and the fate of our agricultural producers.”

An agreement signed on Oct. 3 between Poland, Ukraine and Lithuania transferred product inspections from the Polish border to a Lithuanian port. Ukrainian grain exports, destined for markets in Africa and the Middle East in particular, will be taken directly through Poland instead of first being checked at the Poland-Ukraine border.

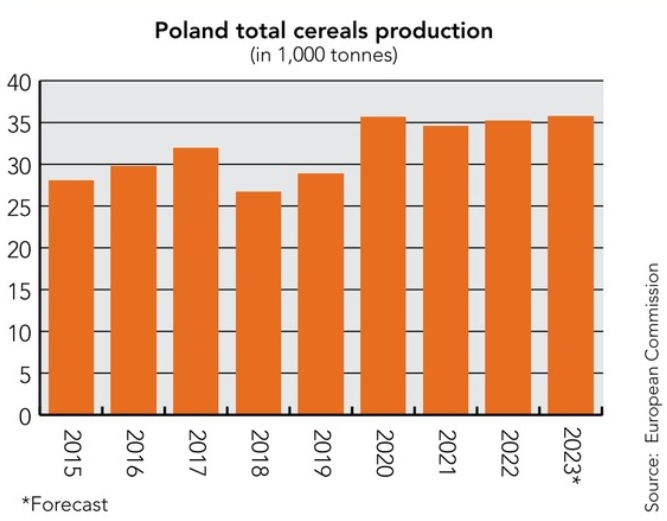

Cereal production is a key component of Poland’s agriculture industry given its climatic and soil conditions. Key grain crops include rye, wheat, barley and oats. Total cereals production in 2023 is expected to drop 1% compared to last year to 35.2 million tonnes, according to Statistics Poland. Excessive rain and resulting soil moisture delayed harvest and caused some quality problems.

Other major crops include potatoes, sugar beets, fodder crops, flax, hops, tobacco and fruits. Animal production is focused on dairy, pig and poultry products.

Production satisfies domestic demand for feed and the nation achieved a record export value of €34 billion in 2020, €2 billion more than the previous year.

Most of its exports go to other EU countries, primarily Germany and the Netherlands. Poland is one of the few EU countries that is developing exports to countries outside of the EU, including the UK, the Commonwealth of Independent States and Saudi Arabia.

Poland is also one of the largest agri-food producers in Central and Eastern Europe and the sixth largest in the EU, according to the US Department of Agriculture (USDA). More than 1,270 companies operated in the sector in 2021, and the industry accounted for more than 9% of the nation’s gross domestic product. The most important segments include meat, dairy, beverage, confectionery, bakery and horticultural processing.

“Consumer demand for products perceived as healthful, international trends and increased incomes are significant drivers of Poland’s food processing industry,” the USDA said in a report on the sector.

Credit: ©SOSLAND PUBLISHING CO.

Crop production, trade

Because of the higher yield potential and drought tolerance, winter crops occupy more land in Poland. Large acreage of winter cereals is also the result of milder winters and the lower risk of crops freezing.

Cereal yields can fluctuate widely over the years due to the variable amount of rainfall. This year, total cereal harvest is expected to drop 1% as rain in August extended the harvest time, leading to an increase in grain moisture, the development of fungal diseases and a reduction in the protein level, Statistics Poland said. Harvest was complete in most of the country by the end of August.

The total cultivated area was estimated at 7.1 million hectares, including 2.4 million hectares of wheat, 700,000 hectares of rye, 600,000 hectares of barley, 500,000 hectares of oats, 1.2 million hectares of triticale and 300,000 hectares of cereal mixtures.

Harvest of basic cereals was estimated at 26.1 million tonnes, 3% down from last year. Winter cereal harvest was estimated at 21.9 million tonnes, 1% less than the previous year while spring cereal harvest was estimated at 4.2 million tonnes, down 14% from last year.

Production of rapeseed and turnip rapeseed is expected to increase 1% to 3.7 million tonnes. Despite a lack of spring rain, plant branching and pod filling were adequate. The seeds from this year’s harvest are of good quality and have a high degree of oil content (above 40%), Statistics Poland said.

In terms of food security, Poland ranks 22nd out of 113 countries and 14th among EU countries. Its food security has seen the second highest growth rate of all EU countries in the last 10 years, according to a study financed by the Netherlands Policy embassy. One Polish farmer can feed 129 people.

Cereal feed production increased to about 24.1 million tonnes in 2020, a 20% increase from the previous year. Domestic market demand for concentrate feed in 2020-21 was estimated at around 22.2 million tonnes. A slight decrease in demand for poultry feed was offset by an increase in demand from pigs.

Poland imports most protein-rich raw materials for feed production, including 2.6 million tonnes of soybean meal (about 70% from Argentina) and 400,000 tonnes of sunflower meal.

Flour milling

Poland has about 400 flour mills with a total milling capacity of about 7.4 million tonnes, according to European Flour Mills. Capacity utilization is estimated at 60% to 70% with mills using 4.2 million tonnes of wheat and 900,000 tonnes of rye per year.

One of the largest milling companies is GoodMills Polska, which has four mills in the country and a capacity of 600,000 tonnes. PPZ KAPKA is another large flour producer and grain processor with a wheat mill in Tarnogrod and a wheat mill and rye mill in Jaroslaw.

Polskie Młyny has two mills, one with a capacity of 800 tonnes of wheat per day and one that mills 390 tonnes of wheat and 50 tonnes of rice per day.

Młyny Szczepanki operates three mills with a total production capacity of 800 tonnes per day. It processes wheat and rye into flour. The company is investing in renewable energy, with a wind turbine and investment in photovoltaic installations to power its mills. It is using an installation with a capacity of 1.25 megawatts with plans to increase to 3 megawatts.

Interchemall Zespoł Młynow Jelonki, established in 1991, operates three milling lines at its 800-tpd rye and wheat facility. The facility includes a flour mixing plant and warehouses with a capacity of 7,000 tonnes of bulk finished product. It supplies products to domestic and foreign markets including bakeries, pasta shops, confectionery plants, food wholesalers, chain stores as well as feed mills and farmers. Its wide range of products include wheat and rye flours as well as specialized flours.

Stoisław produces flour, groats and flakes with a daily production capacity of 600 tonnes of wheat, 200 tonnes of rye, 35 tonnes of barley and 60 tonnes of oats.

According to European Flour Millers, Polish flour consumption is 110 kg a person each year, with bread consumption at 46 kg.

cepa.org

thecritic.co.uk