TheRam

Coach

- Messages

- 13,911

I think we are talking about roughly the same thing but coming from it differently

I agree with the idea of a state bank and we used to have a state bank. I believe it was taken over by Westpac. I also agree that state governments have been awful (so has the federal government) with selling off public assets.

Nevertheless the states would still technically be constrained because a) they would still have to issue the federal reserve currency, the Australian dollar and b) there are reserve limits. For the total amount that a bank loans out that they have a limit or reserve in case the proverbial hits the fan. Although that hasn’t stopped it (the proverbial hitting the fan) happening on multiple occasions.

All in all, I agree that if people actually knew that their tax dollars weren’t supplying the federal government with money to spend but more to the point indirectly helping already rich people with their investments, it would be utter chaos. Nobody would work and I wouldn’t blame them.

Look I appreciate your thoughts and you are correct in some of your points especially the last paragraph, but it is so much worse then what you or many others think. Much simpler to fix too. If you could wave a magic wand and fix the economical system of any country or the world for that matter, you could literally turn everything around within a month and economies would start to function and thrive within a the year as they were intended to.

But we will never get there, because that is not the plan. As for States having restraints, yeah sure, I am not advocating they issue their own currency, but like I said, to big a topic for here and this is not the place for it. But State governments can be so profitable that they can easily run surpluses and build infrastructure programs without any problems raising capital at all, if they simply setup a proper State Bank and built up their asset portfolio as they should if they were actually working for us and doing their fiduciary duty. But they don't work for us.

Look if you want to know more look up Michael Kumhof and Irving Fisher - Chicago Plan Revisited. It is a great place to start.

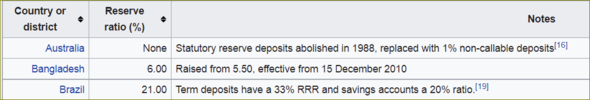

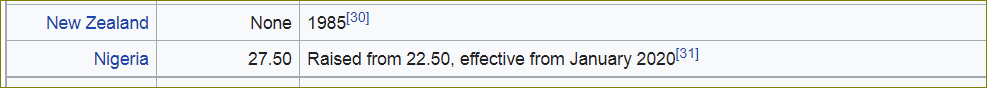

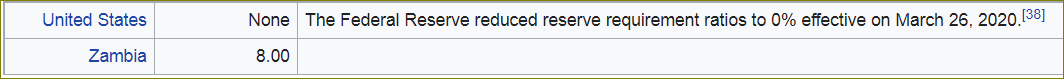

As for reserve limits on the Australian Dollar that hasn't been technically true for many years now and the private banks that are the true issuers of our currency(which should be illegal) they manipulate it to the max. Look at the Aussie, NZ and US reserve ratio in the snippets I cut below. We ride the waves naked my friend.

https://en.wikipedia.org/wiki/Reserve_requirement

https://en.wikipedia.org/wiki/Reserve_requirement